Foreword

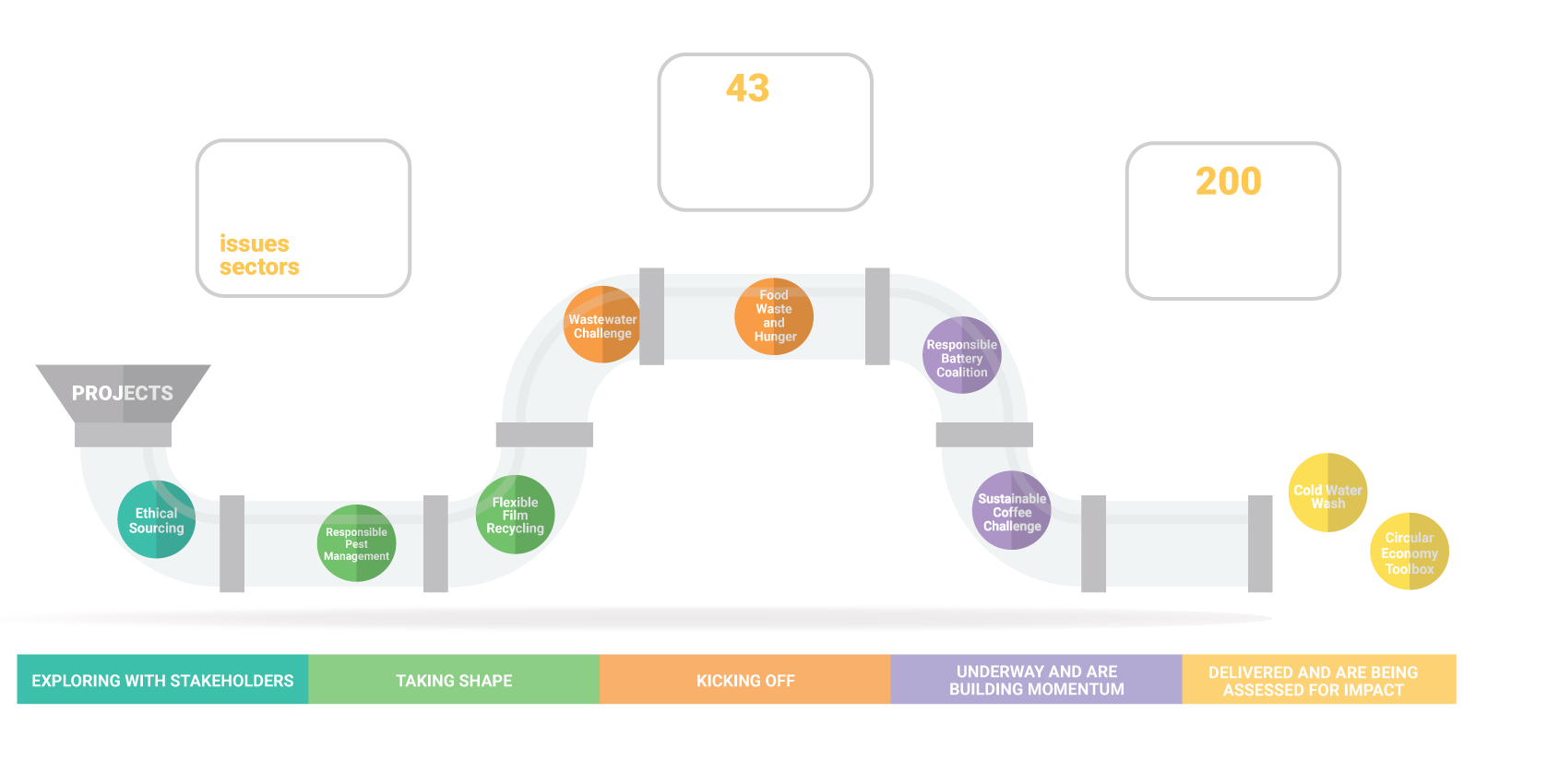

This is The Sustainability Consortium’s (TSC) third annual Impact Report. This report, like the two before it, focuses on how well companies are using the organization’s tools to peer into their supply chains. Over the course of the three reports, TSC has seen expanded use of The Sustainability Index and key performance indicators (KPIs) such that it now covers hundreds of billions in consumer purchasing.

While use of TSC’s tools is growing, I’d liken the experience of the first TSC Impact Report to that of peering through a keyhole. And now it feels like there’s a foot in the door holding it partially ajar, affording a much better view. But why all the effort to fling open this proverbial door so we can have a clear look back across the supply chains that support the products we all use in our daily lives as consumers? Simply put, because supply chains are where both the impacts and the opportunities for improvement are concentrated:

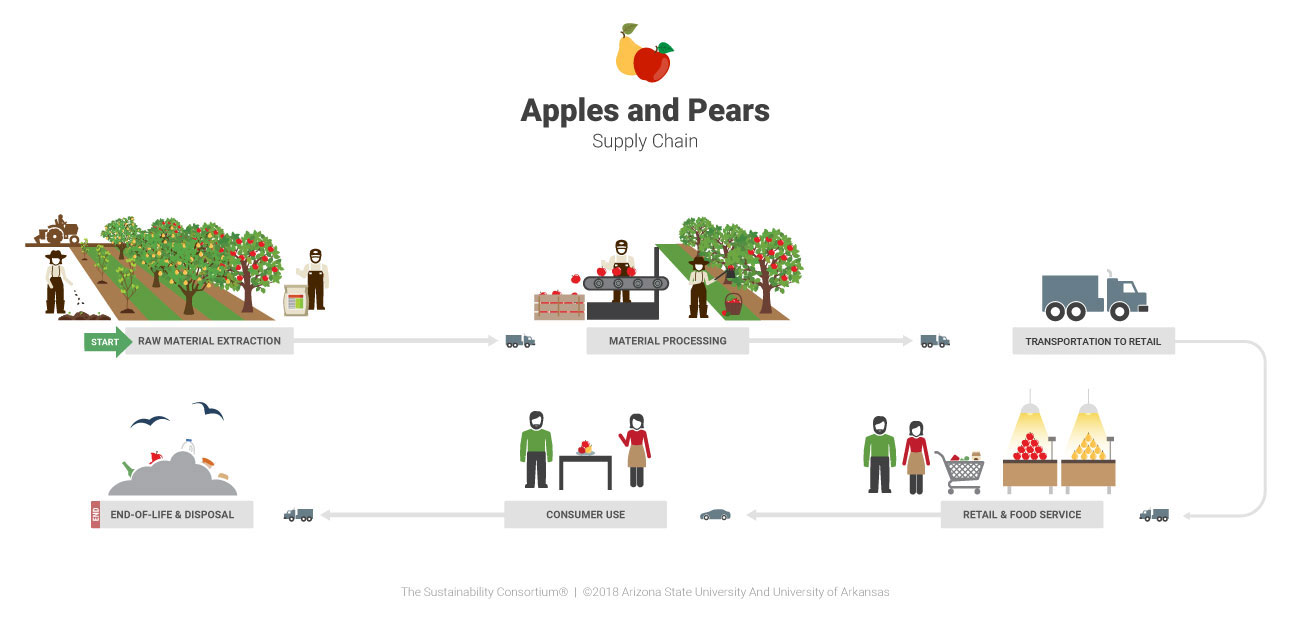

Impacts are heavily concentrated in supply chains. For most consumer-facing companies, 80-90% of the total end-to-end environmental and social impacts are embedded in the upstream supply chain. For some categories, consumer use and end-of life decisions are also hot spots for impacts. But in few cases are the direct operations of a consumer-facing company the largest part of the puzzle – and so to deliver at-scale improvements its critical to look up- and downstream at the entire system a company operates within.

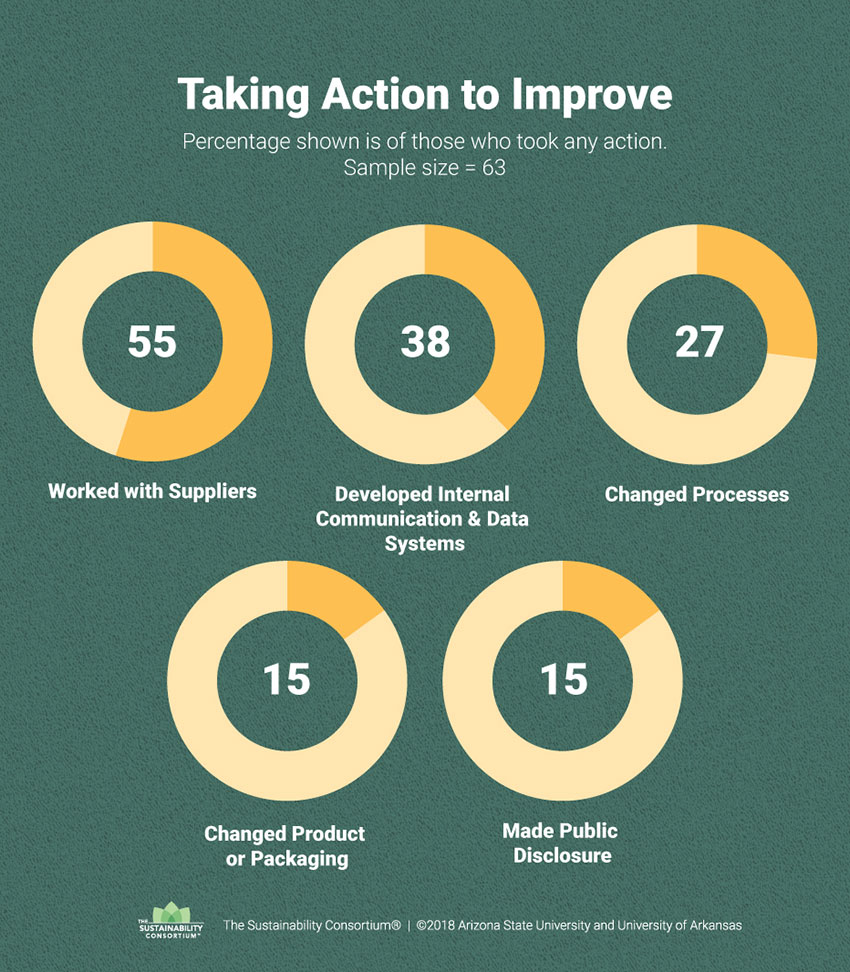

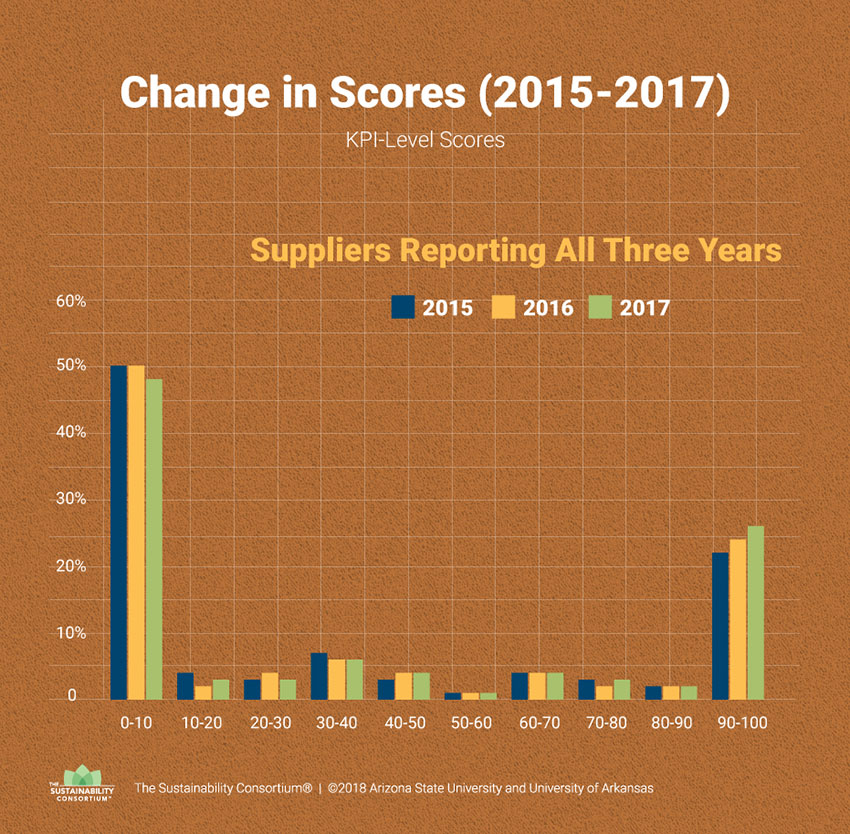

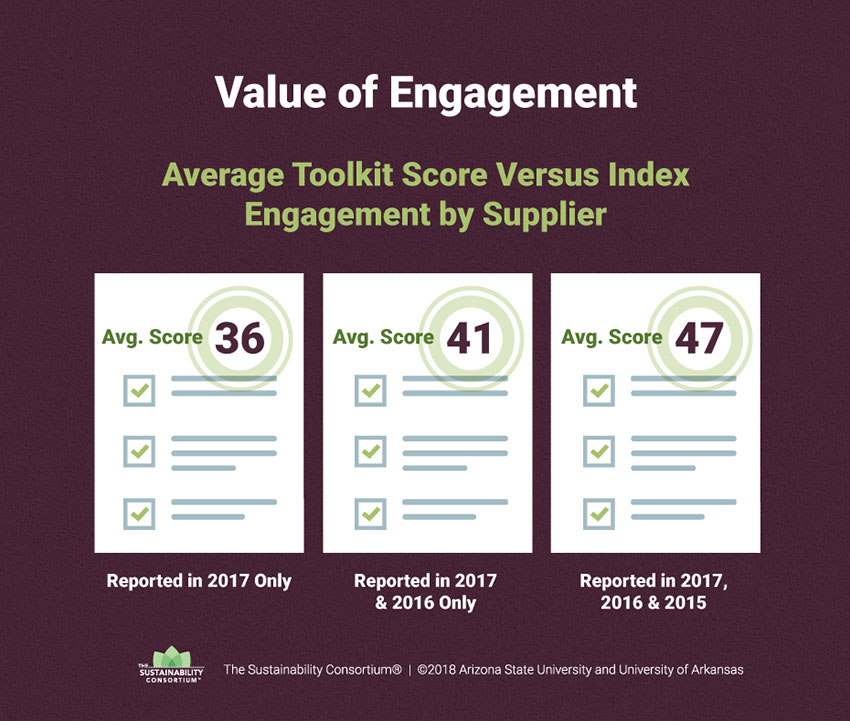

There’s tremendous room for improvement. Now that TSC has been issuing this report for three years, a track record is emerging. What that track record is clearly showing is A) that solid improvements are being made year-over-year, and B) that even with these improvements, there is still plenty of room to improve.

This concentration of both impacts and opportunities for improvement makes supply chains a uniquely powerful place for large companies to focus sustainability efforts. As shown in the examples in this report, one company, or a small group of companies, can set off a chain reaction of tracking and transparency. When a supplier reports data to a many-to-many ecosystem like TSC, all the participating members doing business with that company can get access to the data. In this way, supply chains are a powerful point of amplification.

Supply chain sustainability efforts aren’t just about managing or mitigating the environmental and social impacts of supply chains – these efforts go straight to the root of business value creation. While at McKinsey & Company, my colleague Anne-Titia Bové and I did extensive research on the linkage between sustainability efforts and the profitability and market capitalization of consumer-facing companies. We found that for the 50 largest consumer goods companies in the world, only 50% of their market capitalization was the based on their ability to generate profit today. The other 50% of their market value was based on the expectation that they’d grow their profits in the future.

Without getting deeply into supply chains and driving sustainability improvements, this future growth would come with a linear set of increases in environmental and social sustainability impacts: sales go up 10%, impacts go up a corresponding 10%. These types of linear increases in sustainability impacts would fly in the face of global efforts to address common global sustainability goals set by nearly every government on Earth. In fact, if the 50 largest global consumer goods companies we looked at are to do their fair share to meet the Paris climate agreements and deliver on the growth expectations already priced into their stock, they’ll have to find ways to deliver a dollar of sales in 2050 with only about 10% of the CO2e that same dollar of sales would have had in 2015. Through this lens, supply chain sustainability efforts are an insurance policy on a company’s market capitalization – efforts to de-intensify the environmental and social impacts in supply chains support the continued ability of companies to grow, and expectations of continued growth are what support public capital markets view of the company’s value.

I can’t speak specifically for the CEO of your organization, but I can say that all of the CEOs I know care an awful lot about things that have the ability to impact the value of their company by 50%. And so, at a time when there is a massive international effort going into meeting the commitments of the Paris Agreement, when companies around the world are embracing the concept of science-based targets and committing to do their fair share to get on the so-called two degree (or less) pathway, there is a spotlight on supply chains. TSC’s leading tools are helping companies tackle what is perhaps the hardest part of the journey toward two degrees – pulling the multi-tiered, global, complicated supply chain sitting underneath practically every company today forward towards a better collective future.

Steve Swartz

Chief Strategy Officer

The Wonderful Company